|

|

Part I. Macroeconomic Development

(Bhrama) |

|

Economic

Conditions in 2009

-

G7 Finance Ministers and Central

bankers said that economic activity should begin to recover later

this year;

-

IMF

predicts slow recovery, no growth in 2010;

-

Growth

projection for Cambodia ranged from 6% to -1%;

-

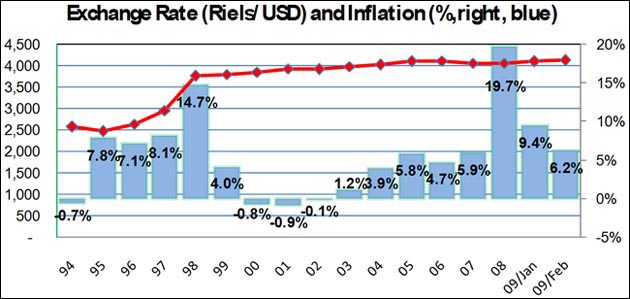

Inflation

has reduced further in 2009 and recorded at 9.4% in Jan and 6.2%

in Feb, y-o-y.

-

The RGC is

committed to maintain 2009 budget and protect social spending,

health and education.

|

|

Exchange

rate is stable while inflation subsided

- In 2008 inflation hit highest since 1994

due to soaring food price and oil price and depreciation of dollar

against currencies of Cambodia’s trading partners, however USD/Riels

exchange rate remains stable.

|

|

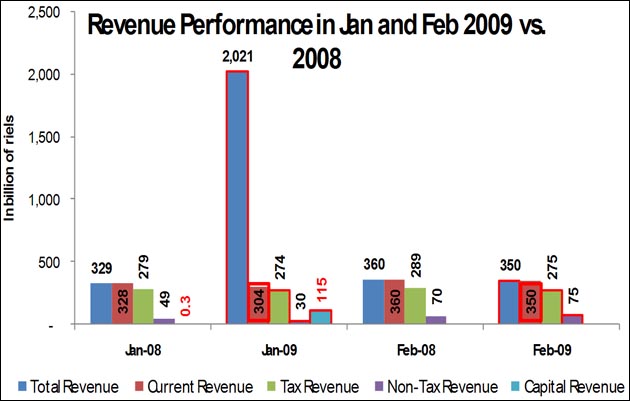

- Total revenue in Jan-Feb 2009 increased by

3.4 times, compared to 2008 due to high capital revenue; current

revenue dropped by 5%.

|

|

Garment exports are slowing down

|

|

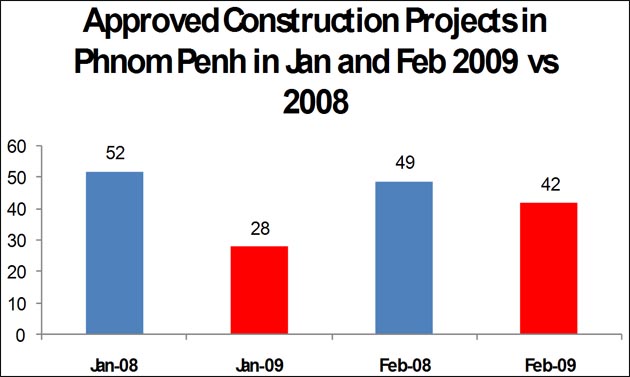

-

Construction

approval, in number of projects, dropped by 44% in Jan-Feb 2009,

compared to Jan-Feb 2008

|

|

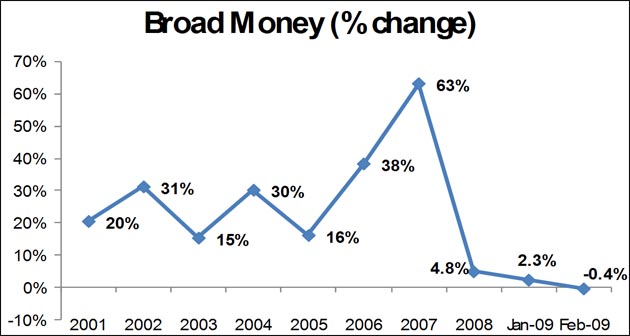

Decline in the growth of M2

|

|

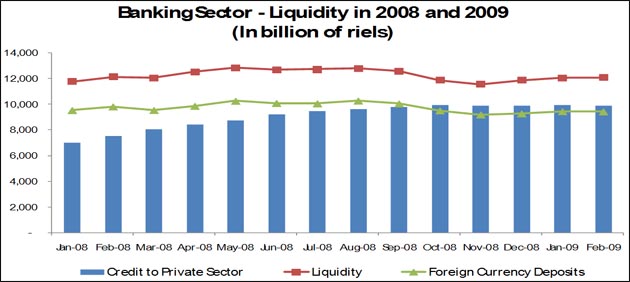

Banking Sector—Liquidity

-

Liquidity dropped by -1.6% in

Sept and -5.4% in October, -2.7% in Nov, but increased by 2.5% in

Dec; foreign currency deposits dropped by -2.2 in Sept, -5.4% in

Oct, -3.3% in Nov, but increased by 1% in Dec, while credit to the

private sector continues to grow by 1.6% in Sept and 1.7% in Oct,

but declined by -0.6% in Nov. In December 2008, credit to the

private sector increased by 0.1%.

|

|

Part II. Policy Options

And

Response Measures |

|

Impacts 1/ |

| A major

slowdown of growth, with an accelerator effect on investment

(already weak and dependent on foreign inflows), export,

tourism. This was caused by external (e.g. a deeper global

recession), and could have feed-back loop on banking sector. |

|

Policy Responses |

|

Create fiscal space |

-

Revenue

mobilization by further strengthen tax administration:

strict measures to recover arrears;

-

The Ministry

of Economy and Finance and all relevant Ministries continue

to mobilize all kinds of revenues in order to meet the

objectives set in the 2009 Budget Law; and

-

Rationalizing expenditure: transfer savings from current

budget to increase investment in high priority areas,

including social safety nets and productivity, transport,

irrigation;

-

Increase

domestic financing, using government bank deposits and

non-bank financing;

-

Increase ODA

disbursements;

|

|

|

Impacts 1/ |

| A major

slowdown of growth, with an accelerator effect on investment

(already weak and dependent on foreign inflows), export,

tourism. This was caused by external (e.g. a deeper global

recession), and could have feed-back loop on banking sector. |

|

Policy Responses 2/ |

|

Improve monitoring |

-

Institutional monitoring: using existing mechanism at

Ministries and agencies to monitor socio-economic

consequences of the crisis;

-

Monitoring

of disbursement: for ADB and WB projects, the MEF will focus

on a monthly report on disbursement;

-

Monitoring

of disbursement: for other projects, quarterly report would

be appreciated; this could improve the quarterly GDP

forecast;

-

For fiscal

issues: TOFE;

-

For monetary

issues: Monetary Survey of NBC;

|

|

|

Impacts 1/ |

| A major

slowdown of growth, with an accelerator effect on investment

(already weak and dependent on foreign inflows), export,

tourism. This was caused by external (e.g. a deeper global

recession), and could have feed-back loop on banking sector. |

|

Policy Responses |

| Relax

monetary policies |

-

Decreased

the reserve requirement to 12%;

-

Remove

credit ceiling on commercial bank credit to the real estate

sector;

-

Enhancing

capital base though the increase in minimum capital

requirement; and

-

Create

overdraft facility to support commercial bank;

-

Further

loosening monetary policy should conditions warrant;

|

|

|

Impacts 2/ |

| Domestic

financial sector vulnerability, from a simple loss of trust in

the financial sector or from a rapid deterioration of asset

quality (either because current risks were underestimated or

misreported, or through a slow-down of the economy or a fall

in property prices). |

|

Policy Responses |

|

Strengthen banking regulations/supervision (with specific

actions as follows) |

-

Improving

classification of banks assets and provisioning;

-

Improving

the valuation of collateral used for bank lending;

-

Further

strengthen the banking system through rigorous

implementation of on-site and off-site inspections and

supervision;

-

Strengthen

credit information sharing system;

-

Strengthen

the system for implementing reserve requirements;

-

Improve

banks internal and external auditing;

-

Strengthening bank liquidity management; and

-

Strengthen

corporate governance of banks and financial institutions.

|

|

|

Impacts 3/ |

| A sudden

stop or reversal of capital inflows, with a magnified impact

in a dollarized economy. This could also trigger difficulties

in financing the current account deficit. |

|

Policy Responses |

|

Adjust policy mix (depending on risk of slower growth), mainly

through fiscal policy (accelerate revenue growth while

containing spending), with support from monetary policy,

especially exchange rate flexibility. (with specific

actions as follows) |

-

Improve the

investment climate (to mitigate the risk of a drastic

slowdown in trade and FDI);

-

Flexibility

of the exchange rate;

-

Encourage

domestic savings; and

-

Continue

mobilization of external assistance.

|

|

|

Impacts 4/ |

| Growth

slowdown in light of drop in commodity prices including the

price of rice and paddy; and the decline in both domestic and

external demand in key sectors. |

|

Policy Responses 1/ |

|

Agriculture intervention (with specific actions as

follows) |

-

Create

Agriculture Support and Development Fund of US$18 million;

-

Zero tariff

on importing agriculture materials such as seeds,

fertilizers, pesticide and agricultural equipments etc.; and

-

Streamlining

procedures and 3 years tax holiday for agricultural

investment projects.

-

Planned

further incentives for investment in processing facilities,

rice milling for exports and investment in irrigation;

-

Streamlined

procedures to promote rice exports;

-

Promoting

farmer organization by setting up cooperatives;

-

Seeds,

fertilizers, agricultural extension, marketing;

|

|

|

Impacts 4/ (cont…) |

| Growth

slowdown in light of the lack of external demand for Cambodian

garment products |

|

Policy Responses 2/ |

|

Garment sector intervention (with specific actions as

follows) |

-

Fiscal

measure: suspension of 1% pre-payment of tax on profit;

-

Special fund

for training program;

-

trade

financing/credit (yet to put in place);

-

Promotion of

supporting industries (product clusters);

-

Improvement

in labor standard, dispute resolution and better relation

between employers and employees with collaboration from

trade unions; and

-

Diversifying

the markets for our garments and other manufactured goods.

|

|

|

Impacts 4/ (cont…) |

| Growth

slowdown in light of the GFC and reduction in tourists

visiting Cambodia. |

|

Policy Responses 3/ |

|

Tourism sector intervention (with specific actions as

follows) |

-

Ensuring

peace, security, political stability, social order and

tourist safety;

-

Building

more tourism infrastructures;

-

Improving

legal framework and institutional capacity;

-

Developing

human resources; and

-

Diversifying

tourist market/destinations and attractive tour packages;

-

Visa fee

waiver could be promoted if this can help;

|

|

|

Impacts 4/ (cont…) |

| Growth

slowdown in light of the GFC and slowdown in investment. |

|

Policy Responses 4/ |

|

Structural Reforms (with specific actions as follows) |

-

Improve

trade facilitation through customs computerization ASYCUDA;

-

Streamlining

procedures to reduce formal and informal costs;

-

Acceleration

of adoption of laws and legislation and their enforcement in

various sectors as part of wider institutional reforms:

support from the National Assembly and Senate is required;

-

Relaxed

procedures are needed at the Council of Ministers to speed

up approval of legal framework by removing the bottlenecks

(although quality benchmarks should be maintained);

-

Frequent

meetings of the Committee on Economic and Financial Policies

to discuss with the private sectors and related parties on

policy responses.

|

|

|

Impacts 5/ (cont…) |

| Growth

slowdown leading to increase in unemployment. |

|

Policy Responses 5/ |

|

Competitiveness and training |

-

Provide

funds of US$6.5 million for short-term scholarship programs

to train some 40,000 workers in agriculture, industry,

handicraft and services;

-

Earmark US$1

million to establish “Fund for Self-Employment” to be

managed by the National Employment Agency to provide

micro-finance to help trained workers to set up their small

businesses;

-

Medium to

long-term reform would be required to increase

competitiveness: electricity, transport, port handling,

customs clearance, reduced inspection, but improved risk

management etc.

|

|

|

Impacts 5/

|

|

Poor and vulnerable groups affected by the

crisis. |

|

Policy Responses |

|

Social safety net |

The rural sector acts

as an informal social safety net in Cambodia |

-

Health

Equity Fund;

-

Food

Emergency Program;

-

Food for

work (WFP) and Mother and Child Health program (WFP);

-

School

feeding programs;

Targeted scholarship programs for secondary education

students;

-

Operationalize the National Social Security Fund; and

-

Pre-paid

health insurance scheme.

|

|

|

|

Thank You

(Churning of the Ocean

of Milk) |

|