|

|

Presentation on developments in the garment industry in Cambodia

and RGC’s policy responses |

By H.E. CHAM Prasidh

Senior Minister and Minister of Commerce

At the 14th Government-Donors Coordinating Committee (GDCC)

Phnom Penh – April 28, 2009 |

|

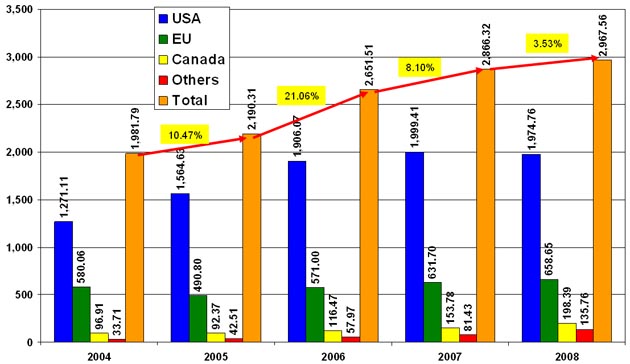

Cambodia’s

total textiles and garment exports to the various markets

(2004-2008)

Value in US$ million |

|

Source: MOC March 27,

2009 |

Total exports: $552.2mn – Data of April 27, 2009 |

|

|

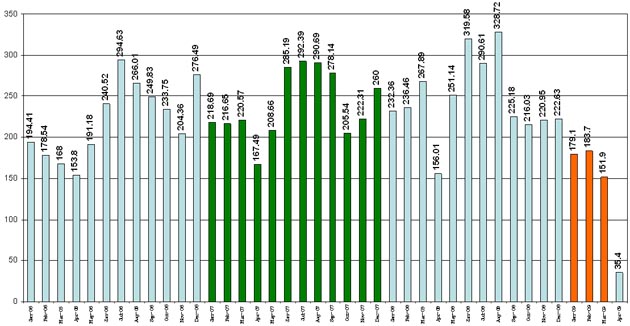

Monthly

Cambodian Garment Exports to the World (2006~2009) |

Source: MOC April 27, 2009 |

|

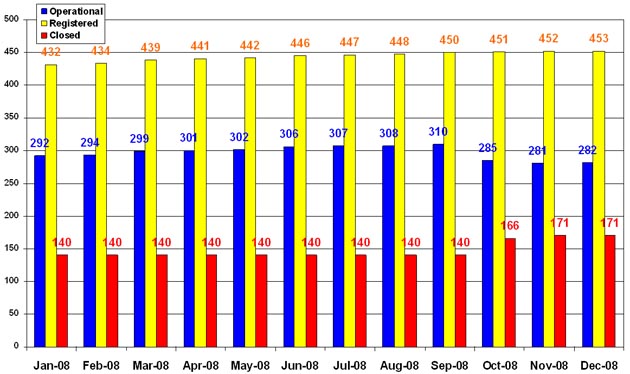

Number of

textile and apparel factories in Cambodia

(Jan 2008 – Dec 2008) |

|

|

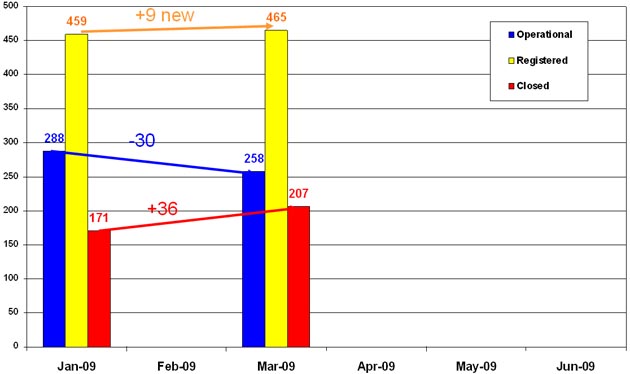

Number of

textile and apparel factories in Cambodia

(Jan 2009 – Dec 2009) |

Source: MOC/DTPS April 2009 |

|

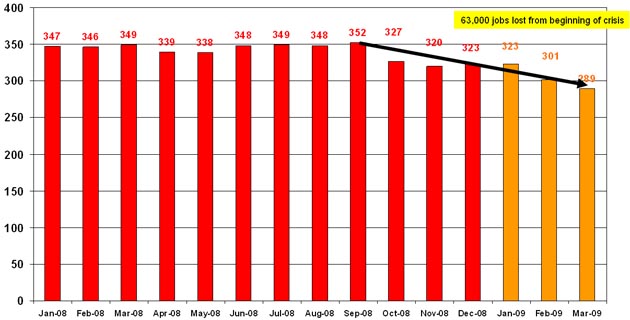

Workforce

monthly evolution in the garment sector

(Jan 2008 – Mar 2009)

(1,000 persons) |

Source:

MOC April 2009

|

|

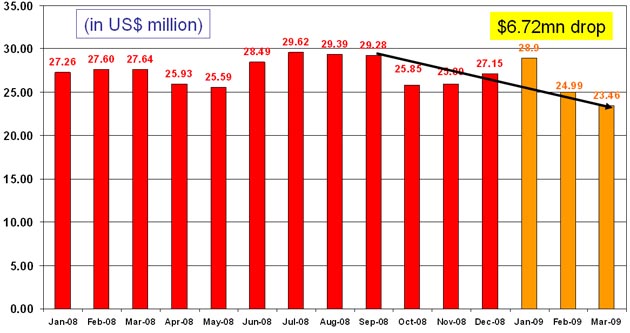

Payroll

monthly evolution in the garment sector

(Jan 2008 – Feb 2009) |

Source: MOC April 27, 2009

|

|

Note: These measures

are applicable to garment sector and footwear sector

|

|

Based on the results of

a joint meeting of the Economic and Fiscal Policy Committee and the

Private Sector Development Steering Committee, chaired by DPM and

MEF Minister H.E. Mr. KEAT Chhon on February 11, 2009

H.E. Samdech Akka

Moha Sena Padei Techo HUN SEN, Prime Minister of the Kingdom of

Cambodia has agreed as follows:

|

-

1% Advanced Profit tax: RGC since last

year has decided to waive this measure for 2009 and 2010 for the

garment sector in order to ask the GMAC to raise wages – now GMAC is

asking to abolish that measure – this is part of the Law on

Taxation, and is related to all types of companies, not just for the

garment sector – the suspension for garments sectors is a loss of

50bn Riels for the RGC based on 2008 data – we ask the garment

sector to understand and as a compromise, the

Royal Government agrees to further waive the collection of the 1%

Advanced Profit Tax for 2 more years (2011 and 2012).

-

Safety net pensions (Factory management

is required to secure 0.8% of wage per month)

the Royal Government agrees to reduce factory management’s burden to

0.5% of wage per month while RGC pay 0.3% to help complement the

payment of those pensions for the period 2009-2010.

[Productivity of the workers need to be

enhanced – need forengagement from factories – in the medium term,

we suggest that each factory join RGC in training program for senior

and middle managers and unions (possible deductible expenses, not

charged into profits tax) – ongoing USAID project]

-

The Royal Government

agrees to create a Fund for vocational training for laid off workers

( not just to cope with current unemployment/purchasing orders drop

problems, but to increase productivity in the sector, too). MEF and

MLVT are tasked to prepare a formal request to the Prime Minister.

-

We shall look for a

more permanent mechanism in which the garment/footwear management

can contribute on a proportional basis of each factory’s size or on

a voluntary basis. This expenditure can be profit tax deductible.

|

|

2.

Streamlining procedure |

[Reduction of costs of transactions

(not business as usual) – find immediate "lower hanging fruits and

quick win" such as online approval]

-

The Royal Government

agrees to push for a speedy and complete implementation of ASYCUDA

World for imports and exports customs clearance

-

The PSD Steering

Committee and its 3 Sub-steering Committees as well as the 8

Government-Private Sector Working Groups shall meet more frequently

and more efficiently to streamline procedures and to reduce formal

and informal transactions costs.

|

|

3. Trade

financing and guarantees |

-

locally the cost is higher and the risk

is higher

-

difficult to guarantee on a higher risk

sector

-

Global Trade Financing Facility of IFC

does exist (ACLEDA is the last resort) – need more study- no

immediate action possible – GMAC may jointly study with IFC and come

out with findings for our purview

-

The Royal Government

agrees to commission further study on possible government’s

involvement while bearing in mind the need to secure a healthy

banking sector in Cambodia.

Note: Maybe the forthcoming

implementation of the ASEAN+3 project called “Chiang Mai Initiative”

could be an opportunity to tap on the pledged $120bn Fund.

|

-

The Royal Government

agrees to call for further tripartite meetings

(Government-Workers-Unions) and the 8th WG on Industrial Relations

to stress the role and responsibility of each key player.

-

The Royal Government

will push for a quick resolution on the issue of unions’

representativeness in the factories and “collective agreement”

between unions and managers.

-

The Royal Government

urges MLVT to speed up with drafting of the Law on Unions (based

on current provisions in the Labor Law and without waiting for the

arrival of a Labor expert)

|

-

The Royal

Government calls on all government entities and local authorities

to help combat garment products’ pilferage for the sake of IPR

protection and keeping purchasing orders.

-

The Royal

Government calls on factory management to enhance management’s

capability and internal governance.

|

|

Thank you for

your attention |

|

|