CAMBODIA

Macroeconomic

Management in Response to Financial Crisis

Second Cambodia Development

Cooperation Forum

Dr. Hang Chuon Naron

Secretary General, Ministry of

Economy and Finance

4th

December 2008

|

Part I. Impact of the

Global Financial Crisis

on Cambodia

|

Impact of the Crisis

-

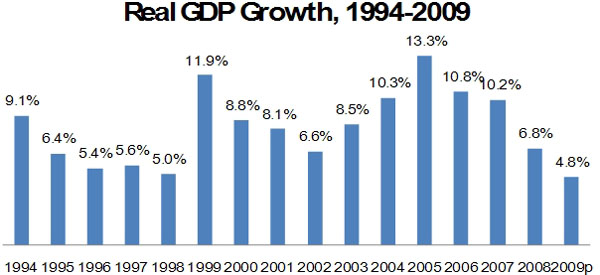

There will be some impact,

mostly indirect to the real sector, resulted in lower

GDP growth in 2008 and in 2009;

-

Cambodia’s banking sector,

as a whole, remains resilient, impact is limited to

small banks;

-

Although the foreign

currency deposits experienced slight reduction, credit

to the private sector continues to grow, drawing on the

excess of liquidity of the banking sector.

|

|

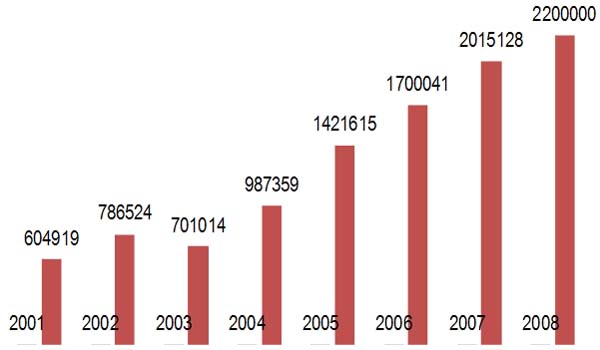

Economic

Growth

|

|

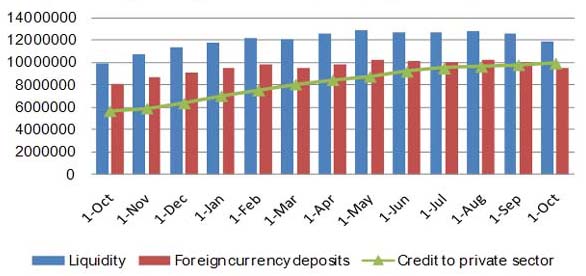

Cambodia’s

Financial Sector

- Cambodia’s banking system remains sound,

well capitalized and highly liquid.

- The capital adequacy ratio (net assets or

net worth/ weighted assets according to the degree of risks)

was 26% in 2007, well above the regulatory minimum of 15%.

- The liquidity ratio (liquid assets/ total

assets) was 50% in 2007. Non-performing loans (NPLs)

declined from 9.5% in 2006 to 3.4% in 2007 and further to

2.6% in June 2008.

|

|

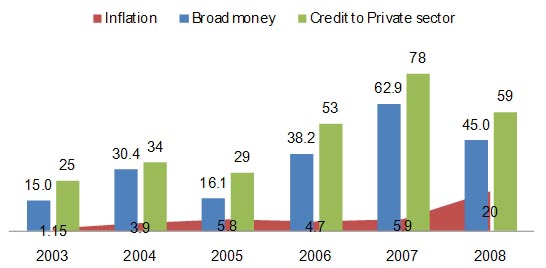

Liquidity of

the Banking Sector

Liquidity dropped by -1.6% in Sept and

-5.4% in Oct; foreign currency deposits dropped by -2.2 in

Sept and -5.4% in Oct, while credit to the private sector

continues to grow by 1.6% in Sept and 1.7% in Oct.

|

|

Tourist

Arrival

|

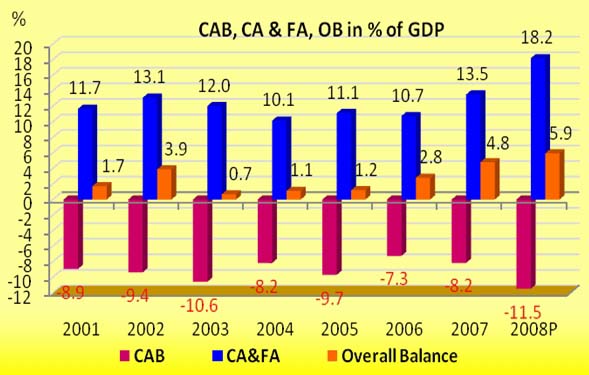

Balance of Payments

|

|

Macroeconomic Policies

- The 2009 budget provide fiscal stimulus

to sustain economic growth;

- Macroeconomic management requires

balancing between promoting growth and reducing inflation;

- Further strengthening of banking sector,

focusing on improvement in supervision, auditing and

institutional strengthening, will continue.

|

|

Part II. Inflation & Policy

Response

|

|

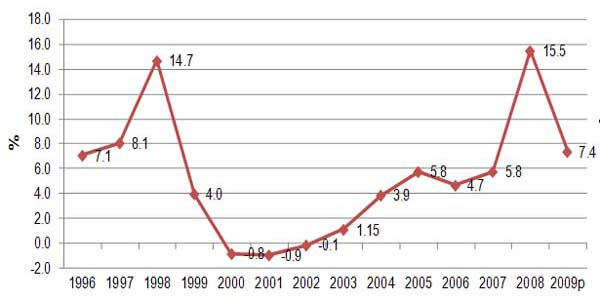

Inflation

(%), Average, Year on Year

|

|

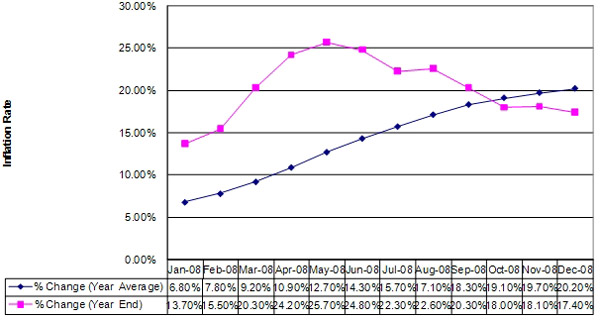

Trends of

Inflation in 2008

|

|

Causes of

Inflation

- Understanding the causes of inflation is

critical for applying the right medicine to cure it.

- There are 3 types of inflation

- Demand-pull inflation

- Cost-push inflation or supply shock

inflation

- Built-in inflation

|

|

Capital

Flows and Inflation

- In recent years, capital flows have

played an increasingly important role in the balance of

payments.

- Since 2005 the capital and financial

account of the balance of payments rose sharply.

- Capital flows have helped to finance

large current account deficits associated with higher

imports and higher economic growth.

|

|

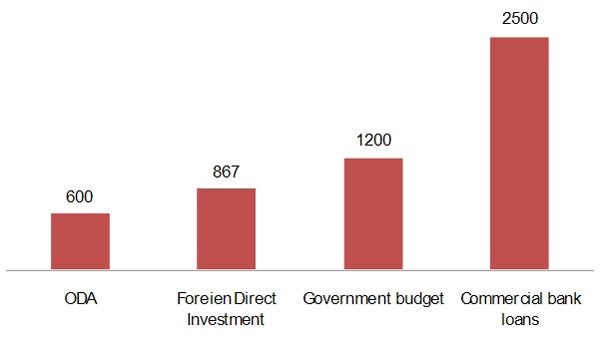

Forms of

Capital Inflows

|

|

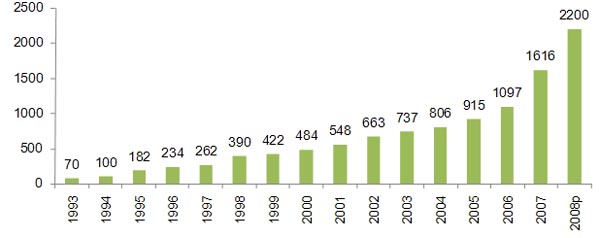

Capital

Flows and Inflation

- Capital flows have induced growth in the

money supply and have caused inflation to rise, as the

National Bank of Cambodia has intervened in the foreign

exchange market to buy excess supply of foreign exchange in

order to stabilize the nominal exchange rate.

- From mid 2006 to mid 2008, Cambodia’s

international reserve position increased by US$1 billion,

while it took 12 years to increase international reserves

from US$100 million in 1994 to US$1 billion in mid 2006.

|

|

Gross

Foreign Reserves, in millions $

|

|

Graph 1.

Money, credit and inflation

|

|

I. The

Resulting Demand-Pull Inflation

-

Caused by increases in

aggregate demand due to increase in private and government

spending.

-

Inflation is caused by an

increase in the quantity of money in circulation relative to

the ability of the economy to supply (its potential output).

|

|

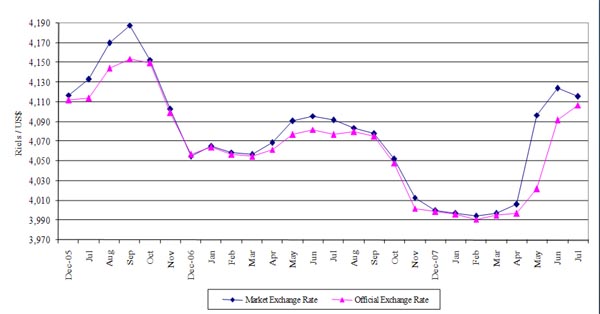

Trend in

Monthly Exchange Rate

|

|

Measures to

Reduce Bank Lending

- NBC imposed:

- (i) a ceiling of 15% on each

commercial bank’s share of total loans to the real

estate sector, with effect from 26 June 2008, and

- (ii) a doubling to 16% of the

commercial banks’ minimum reserve requirement, with

effect from end-July 2008.

- Relax some restrictions on capital

outflows, by allowing commercial banks to invest excess

reserves abroad.

|

|

Policy

Responses to Inflation

- NBC has taken the following monetary

measures

- Conduct prudent and tight monetary

policy

- Pursue the exchange rate policy of

managed float

- Promoting de-dollarization

- Increase reserve requirement of

commercial banks from 8% to 16% to absorb liquidity from

economy

- Allow financially sound banks with

excess of liquidity to invest some of their assets

abroad.

- Increase minimum capital from $13m to

$36.5m for commercial banks and increase to a minimum of

$7.3m for specialized banks

|

|

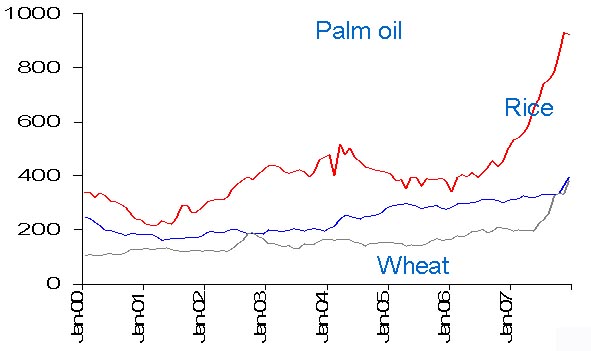

II.

Cost-Push Inflation

- Caused by drops in aggregate supply due

to increased prices of input (like oil, food, wages).

- Higher input cost are then passed on to

consumers in form of higher output prices.

- The acceleration in inflation in large

part reflects the impact of higher energy and commodity

prices.

|

|

Oil Price

($/B, Brent, Dubai, WTI)

|

|

World Price

for Commodities

|

|

Fiscal

Measures to Absorb Shocks

- Real wages of civil servants (e.g.

increasing the base wage by 20%, spouse and children

allowances by 100%, and teacher allowances by 10%),

additional 20,000 riels;

- Subsidies to offset higher fuel and

electricity costs;

- Special financing for rice millers to

increase rice stocks and internal distribution systems and

- Reduced taxation on the importation of

agricultural machinery.

|

Fiscal Policy to Curb

Inflation

-

Re-introduce the imports of

food products such as pork

-

Temporarily suspend for 3

years the 1% minimum profit tax for garment factories, thus

allowing for an increase in minimum wage to employees

-

Reduce customs tariffs and

taxes on imports for the agriculture inputs

-

Introduce temporary VAT

exemption on agriculture products

-

Government cuts down on

spending and increases deposits in the banking system.

|

|

III.

Built-In Inflation

- Induced by adaptive expectation, often

linked to the price/wage spiral.

- It’s a vicious circle where employees

demand increase in salary above CPI rate then employer pass

on the extra cost to consumers.

|

|

Policy

Responses to Inflation

- Public awareness campaign, educational

and policies to increase conservation and energy efficiency

- Improving of agriculture policies which

aim to upgrade infrastructure, irrigation systems as well as

providing subsidies toward high-yield and key agricultural

product like fertilizer.

- Macroeconomic policies will be further

tightened in response to generalized inflation pressure.

|

|

Policy

Responses to Inflation

- Strictly maintain the budget within the

framework of the 2008 Budget Law and continue the policy of

non-bank financing.

- In case of increase in necessary

spending, limit current budget surplus to 2.5% of GDP;

- Maintaining the overall fiscal deficit at

around 1% of GDP in 2008 and 2009 to contain inflation

expectations;

- In case of revenue shortfalls, MEF will

propose new saving measure or reduce/cutting non-priority

expenditures.

|

|

Additional

New Measures

- Strengthened the enforcement of property

tax and unused land tax, including implementation of capital

gain tax;

- Continue to implement public investment

expenditures relates to physical infrastructure along with

education and health sectors;

- All government agencies required to

propose new savings measure and collect revenues from all

possible sources;

- Reduce new recruited government staff by

10% for 2009

|

|

Possible New

Fiscal Measures

- Increase excise on liquor and luxury

goods

- Using actual import transaction prices

for assessing taxation, including alcohol, tobacco and

petroleum;

- Introduce VAT for electricity and water;

- Further strengthen collection of stamp

duties on land transactions;

- Introducing a property tax initially in

major urban areas;

- Increasing excises rates, especially on

beers and cigarette

- Replacing current tax incentives with

investment allowances, tax credits, and accelerated

depreciation.

|

|

Food

Crisis=Risk + Opportunity

- Agriculture, which Cambodia has big

potentials, due to the endowment of land and climatic

conditions

- Physical infrastructure, especially

transportation and telecommunications;

- Electrical power and water supply;

- Human resource development;

- Labor-intensive and export industries;

- Tourism, which Cambodia also has great

potentials, notably with the presence of historical and

cultural heritages, tradition and natural sites, such as

forests, lakes, sea and attractive scenery

|

Macroeconomic Management in Response to Financial Crisis |